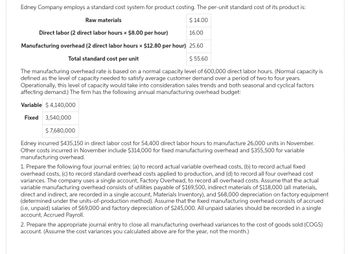

The simple examples are supplied on this part for the sensible understanding of how to submit the salaries payable journal entry. Proper wage accounting additionally allows matching of prices with sure period. This aids good reporting and assists in properly preparing financial statements. To account for unpaid wages, accumulate the variety of hours worked by staff for the period after the last pay interval and thru the tip of the reporting interval. Multiply these hours labored by the wage rate for each worker to derive gross pay. It may be necessary to derive extra time pay, shift differentials, and piece rate pay, if these kind of compensation expense have been additionally incurred by the employer.

Adjusting Entries Take Two

Supplies will increase (debit) for $400, and Money decreases (credit) for $400. When the corporate recognizes the supplies usage, the following adjusting entry happens. Let’s say an organization paid for provides with money within the quantity of $400. At the top of the month, the company took a listing of provides used and decided the value of these provides used during the period to be $150.

- The journal entry is debiting wage payable $ 5,000 and credit cash $ 5,000.

- At the top of each month, the company must document the quantity of insurance expired during that month.

- By the end of December, all 12 months will have been used up, so it is important to acknowledge a portion of the prepaid insurance as an expense each month.

- Over time, as the advantages are realized (for example, because the pay as you go companies are used or consumed), the asset is decreased, and the expense is recognized.

- Nonetheless, the correct journal entry for accrued salaries is important on the period-end adjusting entry.

Chartered accountant Michael Brown is the founder and CEO of Double Entry Bookkeeping. He has worked as an accountant and marketing consultant for more than 25 years and has constructed monetary fashions for each type of industries. He has been the CFO or controller of both small and medium sized firms and has run small companies of his personal. He has been a supervisor and an auditor with Deloitte, a big 4 accountancy firm, and holds a level from Loughborough College.

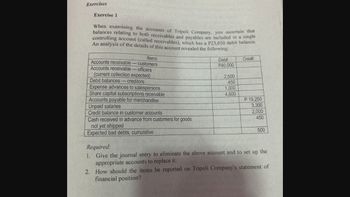

After making the adjusting journal entries, post them to the suitable accounts within the common ledger. This step updates the account balances to replicate the changes, guaranteeing that every one financial activity is properly recorded before the monetary statements are ready. The accrued depreciation account is a contra-asset account that displays the whole depreciation recorded over the years. This allows the corporate to indicate the machinery’s present e-book worth on the balance sheet and accurately mirror the depreciation expense on the income statement.

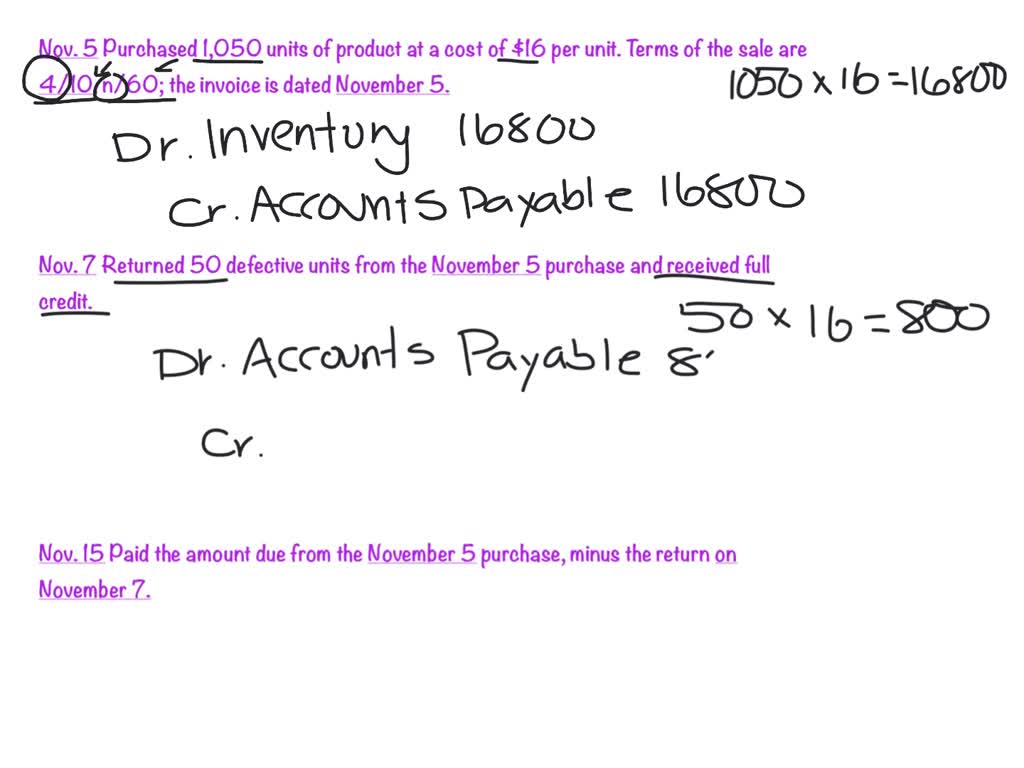

For example, the corporate ABC has the policy to make payments every two weeks of the work accomplished to employees that have labored for multiple week. The wages of latest employees who’ve started working and have labored lower than one week will be accrued for the following cost period. In the above-mentioned article, we have clearly defined the method to move the wage payable entry in Tally. So, in India, you are liable for taxes which are often deducted at supply by firms as TDS (Tax Deducted at Source).

Salary Payable Journal Entry In Tally

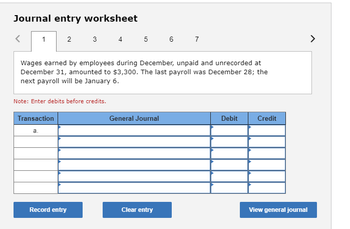

Unpaid wages are wages which have been earned by an employee but which have not yet been paid on the finish of the accounting period. Under the accruals accounting idea bills must be matched to revenues, so an adjusting entry is required to post the unpaid wages for the interval. Later when the corporate makes the cost to the workers, it could possibly make the journal entry to remove salary liabilities by debiting salaries payable account and crediting cash account. The adjusting entry for an accrued expense updates the Taxes Expense and Taxes Payable balances so they are correct on the finish of the month. The adjusting entry for an accrued expense updates the Wages Expense and Wages Payable balances so they’re correct on the end of the month.

These bills usually arise when services are obtained or obligations are incurred earlier than the cash payment is made. Sometimes a whole job isn’t accomplished inside the accounting period, and the corporate is not going to invoice the client until the job is accomplished. The earnings from the a part of the job that has been accomplished must be reported on the month’s revenue assertion for this accrued income, and an adjusting entry is required. This journal entry is to remove the $15,000 of liabilities that the company ABC has recorded in the December 31 adjusting entry.

Nevertheless, one important fact that we need to handle now is that the e-book worth of an asset just isn’t essentially the worth at which the asset would promote. For instance, you might have a building for which you paid $1,000,000 that presently has been depreciated to a guide worth https://www.simple-accounting.org/ of $800,000. However, today it may sell for more than, lower than, or the identical as its e-book value.

Verify that every adjustment aligns with the monetary transactions and complies with the company’s accounting insurance policies and standards, corresponding to GAAP or IFRS. This evaluation ensures that the financial statements present an correct and fair view of the company’s monetary position. This adjustment ensures that the December revenue statement reflects the income earned, even though the money will be obtained in January. For accountants, especially financial controllers, these changes are an important part of the month-end or year-end closing process. Understanding what to adjust and when is key to maintaining accurate books and producing dependable financial statements.

The accounting at the time of recording salaries requires the recognition of each an expense as well as a legal responsibility. This is recorded via a known as the salary payable journal entry. This entry signifies how much the corporate owes its employees for companies already rendered but not but compensated. Why as a result of it finally impacts the P&L account in addition to the steadiness sheet. When recorded in the journal, it’s the unpaid wage expenses that present as a liability. This entry brings you when salaries fall due on the end of a month however not yet paid.